Introduction

One of the main forces behind economic expansion and the reduction of poverty is the accessibility and utilization of low-cost financial services by all societal segments. There are particular challenges in attaining complete financial inclusion in a vast and diverse nation like India.

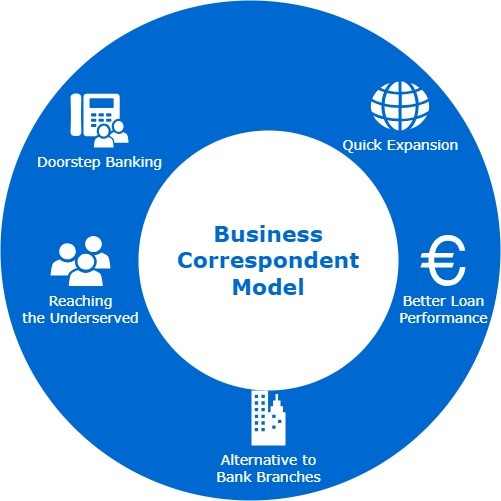

However, the Business Correspondent (BC) model has emerged as a revolutionary force, bridging the gap between traditional banking services and the underprivileged population through the use of technology and creativity.

The concept of Business Correspondent Model

The Business Correspondent model is a framework that enables banks to extend their reach and supply financial services to rural and unbanked areas through middle-men known as Business Correspondents.

These correspondents function as bank representatives and conduct various financial transactions on behalf of the bank, bringing official financial services closer to the doorsteps of those who previously had limited access.

Key Benefits of the Business Correspondent Model

Increased Availability

The Business Correspondent approach uses the current network of local agents to function as Business Correspondents, including post offices, self-help groups, and Kirana store owners. Through their integration into the communities they serve, these agents increase underserved and rural populations’ access to financial services.

Technology Driven Approach

One of the pillars of the BC model’s emphasis is on utilizing technology to deliver financial services efficiently. BCs allow secure and convenient banking services in places with limited physical infrastructure by using biometric identification, mobile banking, and smart card-based transactions.

Financial Awareness

Business correspondents play an important role in increasing financial literacy among the unbanked. They help individuals understand the necessity of formal financial services and empower them to make informed financial decisions by guiding them through the benefits of savings, credit, and insurance products.

Credit Access for the Unbanked

The BC model makes it easier to extend loans to individuals and small enterprises that were previously excluded from mainstream banking systems.

Business Correspondents help financial institutions give microloans and credit facilities to the underserved by completing detailed assessments and using digital records, thereby boosting economic growth.

Government Programs and Subsidies

The BC model has been useful in executing various government initiatives and ensuring the proper distribution of subsidies and benefits. Business Correspondents serve as a critical link between beneficiaries and government organizations, enabling smooth transactions and decreasing the chances of error in organizing welfare programs.

Challenges and Opportunities

While the Business Correspondent approach has helped increase financial access, several issues remain. Infrastructure limits, connectivity issues, and regulatory barriers must be cleared to fully exploit the model’s potential.

It is very important to improve digital infrastructure, extend internet connectivity, and enhance regulatory frameworks to overcome these challenges.

Furthermore, regular training and capacity building programs should be established to improve the abilities of Business Correspondents so that they can efficiently provide comprehensive financial services. Financial institutions, technology providers, and legislators must work together to establish an ecosystem that promotes financial inclusion.

Conclusion

The Business Correspondent model has proved to be a game changer in India’s quest for financial inclusion.

The BC strategy uses technology, empowers local agents, and raises financial literacy to equip previously underserved populations with affordable and modern banking services.

The Business Correspondent model is a ray of hope as India keeps moving closer to closing the financial gap, opening the door to a more prosperous and inclusive future.